Economic Factors Impacting EMS Manufacturer Cost Inputs and Electronic OEM Profits

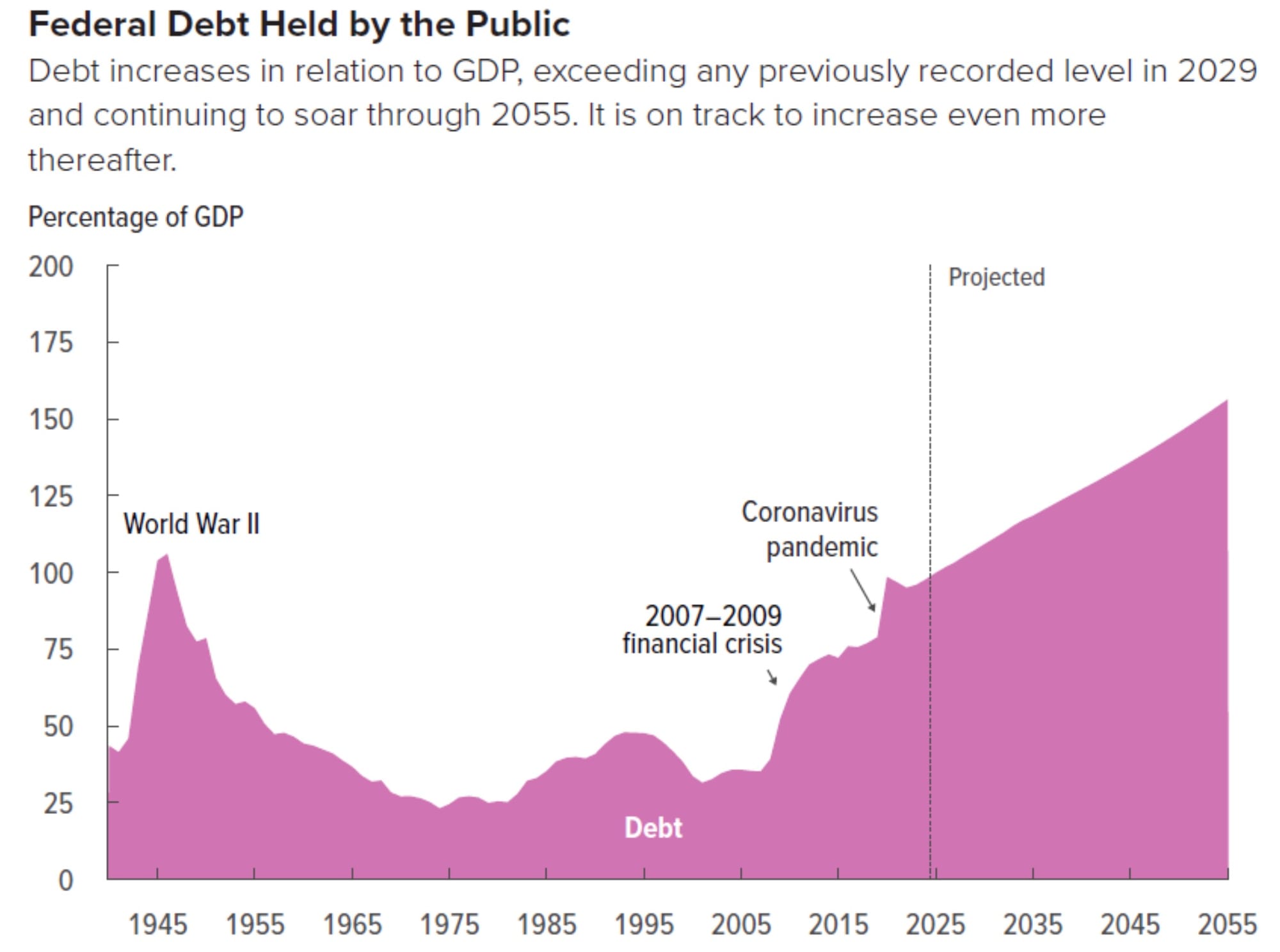

Trends in global economic factors like money supply growth, US dollar strength, and borrowing costs significantly shape dynamics between OEMs and EMS providers, influencing cost structures, demand patterns, and decision-making. Rising federal debt levels amplify these pressures, as increased government borrowing strains economic stability and increases uncertainty impacting contract negotiations between OEM and EMS companies.

According to zerohedge on X, the "US to add $19 trillion in debt over next decade according to the CBO's conservative estimate and debt as % of GDP will double by 2053 to 195 percent." Contact me if you want a link to this PDF report.

Sustained money supply growth (M2) fuels liquidity, typically driving electronics demand as OEMs scale production, while a weaker dollar (DXY) erodes OEM purchasing power, intensifying cost pressures and highlighting EMS providers’ leverage in higher demand markets like robotics and AI.

EMS providers, wanting to capitalize on strong demand, gain leverage in contract negotiations, focus on their cost and profit centers when marketing services and often embedding higher margins in quotes to offset rising material and labor costs.

This behavior by EMS is pronounced during periods of increased demand where EMS manufacturers prioritize OEM customers and programs with greater profitability, leaving OEMs in complex, high-mix, low-volume segments like industrial robotics, medical or aerospace, vulnerable to inflated pricing or productivity expansion constraints.

IPC's (North American) EMS book-to-bill ratios recorded above 1.0 signal positive or robust demand for manufacturing services, creating a seller’s market where EMS providers hold the upper hand.

This trend pushes OEMs to compete for limited capacity, particularly when EMS companies prioritize larger contracts or clients with less price sensitivity. While still above 1.0 today EMS book-to-bill has been trending downward and EMS providers have been losing leverage - opening doors for many OEMs to re-negotiate terms.

Meanwhile, recent EMS industry North American shipment trends reveal volatility driven by supply chain disruptions, such chip shortages and tariffs, which force OEMs to navigate unpredictable production scheduling and uncertain FGI delivery schedules. Feedback from OEM and EMS reveal some EMS providers have responded by selectively fulfilling orders for customers with established relationships or higher-margin programs, leaving smaller OEM programs to face delays or premium pricing for services.

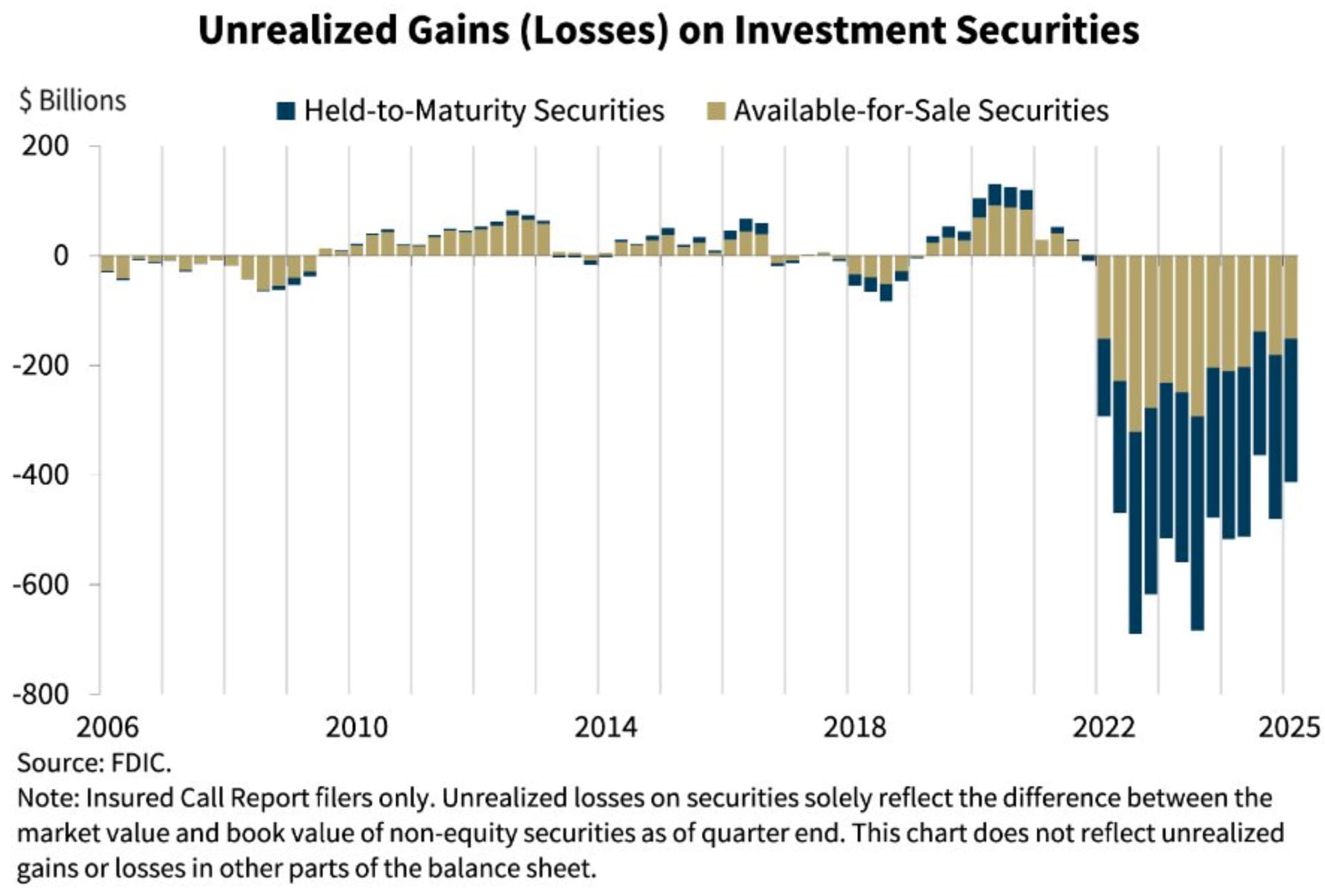

Rising borrowing costs, reflected in higher Treasury yields, further complicate economics in the OEM-EMS relationship. OEMs face increased financing expenses, squeezing budgets for capital-intensive projects, while EMS providers may pass on their own borrowing costs through higher quotes.

Below, US banks are now sitting on $413 billion in unrealized losses as of Q1 2025. This is from holding long-dated bonds on bank balance sheets they purchased when rates were more favorable. Banks have been re-categorizing these bonds as held-to-maturity to conveniently make their balance sheets appear more healthy.

Meanwhile, credit markets for manufacturers have been tight for quite a while and many local and regional banks, where manufacturers typically borrow, are strapped. So are many in the top 10 banks ranks. This, accompanied by manufacturers facing uncertainty, and more layoffs in many markets and industries, saving scarce cash to meet future quarterly obligations.

This perfect storm amplifies the risk of hidden margins by EMS firms for OEMs as EMS companies that exploit true internal costs with opaque pricing structures, particularly in complex, high-mix and low-volume programs. Read more about banking and credit markets impacting manufacturing in the article I embedded below.

OEMs, in response, are increasingly adopting rigorous, qualifying checklists and cost-modeling strategies for the request-for-quote (RFQ) process, better understanding EMS quote pricing drivers, scrutinizing material, labor, overhead charges and more to uncover savings.

Some OEM efforts are saving 10 to 20 percent. This approach counters tendencies by EMS providers to inflate costs when many businesses are stressed and when demand outstrips capacity.

To mitigate some of these risks OEMs are prioritizing supply chain resilience, diversifying their EMS partnerships across regions in Europe, US, Mexico, and Asia to reduce dependency on single providers and manage ongoing tariff dynamics.

This strategy counters EMS companies’ regional biases, where many EMS have prioritize local or high-margin markets. Warehousing and flexible inventory terms in contracts are also critical because they shift shortage risks to EMS providers, protecting OEMs from spikes in fees and costs during supply chain disruptions.

EMS companies push back on these terms unless incentivized by long-term contracts or volume commitments, highlighting the need for OEMs to negotiate contracts strategically.

Financial risk management is another key OEM response to economic uncertainty and volatility. By securing fixed-rate financing, OEMs can shield themselves from rising borrowing costs while contracts that allocate inventory risks to EMS providers can help preserve cash flow.

EMS companies aware of these pressures may push back by demanding higher upfront payments or stricter payment terms, particularly in high-demand periods or industries. OEMs counter this by leveraging real-time EMS industry and financial market insights, monitoring EMS best practices vs practices common in EMS industry, indicators like money supply growth and currency trends, especially for enterprise firms with extended contract electronics manufacturing supply chains, to anticipate cost spikes and adjust budgets and negotiations accordingly.

The EMS landscape demands that OEMs adopt a strategic, data-driven approach to thrive. By emphasizing cost transparency, aligning with EMS providers whose capabilities match specific program specs, ensuring supply chain stability, and proactively managing financial risks, OEMs can navigate the power imbalances in the OEM-EMS relationship. EMS providers must balance profitability with reliability to maintain long-term partnerships. This dynamic interplay of behaviors - OEMs pushing for transparency and flexibility, EMS providers leveraging demand for margin gains - defines the competitive electronics manufacturing ecosystem where informed decision-making is critical for sustained success.

______________________________________________________

About

What matters when formulating contract electronic strategy? How do you identify supplier profit centers and what are you doing to protect against margin erosion for your outsourcing programs? Why do provider capabilities often not match capabilities they claim? How are you benchmarking your supply chain against competitors?

I’ve spent 25+ years in contract electronics industry setting up contract electronic divisions and running operations, protecting EMS program profits, manufacturing capacity M&A and more. I run a technology solutions firm. A lot of times this means asking the right questions.

______________________________________________________