Supply Chain Productivity and Staffing Trends

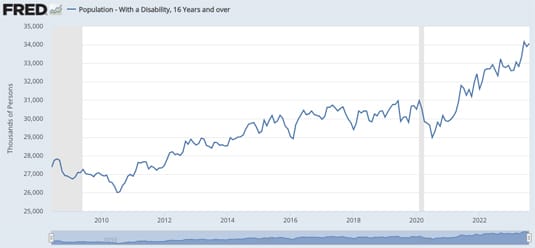

Some manufacturers and suppliers I speak with are seeing as much as 60% of their employee staff out sick as much as 25% of the time, which, in the US, is underscored, perhaps, by the increasing number of workers on disability as reported by the Federal Reserve Bank of St. Louis.

Manufacturing decision makers and suppliers are becoming more vocal expressing productivity concerns in conversations: staffing shortages, outdated processes and procedures, old documentation from previous mergers and acquisitions still being used months, even years, post M&A completion. These are just some of the challenges leading to declining efficiencies in manufacturing supply chains despite stories about AI and automation.

Some companies I speak with are seeing as much as 60% of their employee staff out sick as much as 25% of the time, which, in the US, is underscored, perhaps, by the increasing number of workers on disability as reported by the Federal Reserve Bank of St. Louis. Data and details on the FRED website here.

US Population with a disability - 16 years and over

This gap in productivity and efficiency inside manufacturing supply chains today appears to impact every functional department supporting manufacturing, product quality, and finished goods inventory scheduling and shipping delivery commits. Disability among the US population ages 16 and over is up 3.1 million (10%) from pre 2020 high. See chart below, also from FRED.

Employed US Population with a disability - 16 years and over

Disability among the employed US population 16 and over is up 1.8 million (30%) from pre 2020 high.

From a productivity perspective, the rate of change is higher for the 'employed and disabled' US population. There is a growing number of US workers, aged 16 and older, who are working disabled.

US Manufacturing labor productivity

As the chart above reveals, productivity output per hour has been trending lower. To stay on top of this, some manufacturers are hoping, and struggling, to implement new, company-wide systems and databases to identify, prioritize, and combat these seemingly evasive 'markers' tied to declining productivity.

And they're doing this while still performing manual input entering of front-end purchase orders, contract procurement terms, FGI quantities, weights, SKUs...and, thus, creating errors, on top of errors.

To make matters worse, inaccurate data is then sent by servers to supply chain team members sprinkled across different geographies, in different time zones, with different currency exposure risks creating nightmares for compliance managers.

It is not a stretch to say the gaps between manufacturer actual internal systems and management capabilities to manage execution and oversight, vs capabilities needed by manufacturing enterprises to efficiently solve problems before they occur, are beginning to manifest in declining quality of manufacturer products shipped in the marketplace, and customer (dis)satisfaction.

Worker complaints

A frequent complaint manufacturing factory managers are hearing from workers is "we can't do this because our requirements are different", or "that won't work for us because [insert excuse here]."

From my experience working decades with extended contract electronics supply chains this fallacy leads companies to think they need customized processes, or specific procedures, for solving important enterprise-wise systemic problems.

In nearly every client project, we found that implementation of suitable processes and procedures resulted in useful knowledge and applications that can be administered to get manufacturing and support departments to 85% readiness.

Meanwhile, it's not surprising sleepy project execution and inadequate systems lead to costly and wrong decision-making. It is becoming common to find even Fortune 50 company manufacturing work sites with poor knowledge and inadequate data flowdowns to other team members.

Take, for example, some manufacturers are moving to Microsoft Dynamics D365, away from SAP, hoping MSFT might save them. Yet memory is fading.

It was just a few years ago, Covid-19 marked the end of just-in-time (JIT) inventory management in manufacturing industry as many manufacturers were suddenly left high and dry. Manufacturers with extended contract manufacturing supply chains, for the first time, learned to truly rely on remote technologies and human nature.

Even some of the top manufacturing executives who fought day in and day out to maintain order and control found themselves during Covid lockdowns succumbing to native traits and unable to drive, or focus, on what to prioritize and solve. (Read about SAP ERP challenges)

Formulating strategy

As manufacturers increasingly search for ways to become more competitive, mandates determined in board rooms to focus on cost and spend become more visible in management meetings. For electronics product and equipment companies the question becomes, "How can we make cost modeling decisions and budget forecasts for our programs based on lowest costs for components and materials on our BOM?"

In the past, these concerns have typically come from commodity sourcing, purchasing and category managers.

Keeping in mind, materials costs can make up sixty to eighty percent, and more, of total electronics equipment product costs. Part of the answer to the question above is a distribution issue. How can any manufacturer know if they are getting the best price? Having familiarity with business nuances in market verticals plus, knowing how contract manufacturers, distributors, semiconductor and connector vendors set pricing can help.

But pricing is, more often than not, based on perceived (vs actual) availability, and semiconductor chip and components distributors make side deals with contract manufacturers.

Yet, even components distributors are not fully open with EMS manufacturing partners when it comes to BOM components pricing, inventory supply, and database availability.

The truth is original equipment manufacturers (OEM) are losing internal knowledge and expertise as thinning in the ranks of higher 'skilled' manufacturing workforces everywhere are depleted as workers become ill, or leave and take valuable and actionable process and legacy systems information with them.

Management of change (MOC) boards

Wide-spread workforce inadequacies in the manufacturing enterprise have, today, reached escape velocity, unfortunately.

But not all hope is lost. Enterprises wanting help to assess internal contract manufacturing management capabilities and aligning department goals with corporate business objectives can find plenty of consulting firms will to help.

One way manufacturers can snap back is, first, by realizing something is not working.

Turning focus inward, savvy manufacturers invest scarce resources and energy to identify challenge areas, alignments and shortcomings in staffing, roles and responsibilities.

Processes and procedures are also closely evaluated.

This is followed with management of change (MOC) boards and specific milestones and objectives assigned to key team members and department heads. Gone are the days manufacturing product issues were primarily rooted in disconnects between marketing/sales and engineering.

Competitive positioning begins starts with staffing focus

Organizations are living and breathing entities comprised of people. Having the right people in place is important. Manufacturers benefit immensely from suitably-staffed new hires to lead, manage, and implement and dial-in best practices (vs practices common in industry), prepare and get proper documentation lined up, etc...

Venture Outsource can assist with your staffing needs. We collaborate with you and create roles and responsibilities based on your specs and our experience in contract manufacturing industry. We leverage our vast network, and even post job openings to drive inbound interest, if needed, while working discreetly.

We interview, qualify (and disqualify) candidates. We send you only qualified candidates vetted by us. All you have to do is determine whether you can work with them.

Processes and procedures

Many Venture Outsource clients also leverage our proprietary frameworks for identifying criteria used to vet and select contract manufacturers. This often includes preparing effective quote packages with cover letters designed with longer term strategic positioning when first engaging contract manufacturers - prior to receiving quote pricing from providers you are considering.

Also provided are meeting agendas we have already prepared based on our vast experience, plus detailed information about EMS factory touring dos and don'ts, questions when meeting with provider management, and various other project deliverables.

Contract manufacturing supplier quote pricing analysis and comparison

Another key activity where manufacturers can beef up capabilities when sourcing contract electronics solutions is identifying ‘internal’ supplier factory costs while optimizing product bill-of-materials (BOM) target ‘should cost’, and optimizing total land cost.

Depending on manufacturing needs, we can help most manufacturers with our costing modelers and tools, complete with detailed training comparing EMS and CM program quotes from multiple suppliers, identification of excessive provider program fees and costs, and more leading to improved production planning and inventory management capabilities, reduced risks tied to outsourcing program cost escalations and overruns - all defensible using our modelers. You can even run real-time ‘what if’ scenarios during provider contract negotiations.

Explorers and thinkers

Click any of the links in this article, you can obtain a wide variety of information on related topics and additional resources that can help you to create a Starfleet force field to better protect your contract electronics supply chain.

It is not a stretch to say the gaps between manufacturer actual internal systems and management capabilities to manage execution and oversight, vs capabilities needed by manufacturing enterprises to efficiently solve problems before they occur, are beginning to manifest in declining quality of manufacturer products shipped in the marketplace, and customer (dis)satisfaction.

Worker complaints

A frequent complaint manufacturing factory managers are hearing from workers is "we can't do this because our requirements are different", or "that won't work for us because [insert excuse here]."

From Venture Outsource's experience working decades with extended contract electronics supply chains, this fallacy leads companies to think they need customized processes, or specific procedures, for solving important enterprise-wise systemic problems.

In nearly every client project, we found that implementation of suitable processes and procedures resulted in useful knowledge and applications that can be administered to get manufacturing and support departments to 85% readiness.

Meanwhile, it's not surprising sleepy project execution and inadequate systems lead to costly and wrong decision-making. It is becoming common to find even Fortune 50 company manufacturing work sites with poor knowledge and inadequate data flowdowns to other team members.

Take, for example, some manufacturers are moving to Microsoft Dynamics D365, away from SAP, hoping MSFT might save them. Yet memory is fading.

It was just a few years ago, Covid-19 marked the end of just-in-time (JIT) inventory management in manufacturing industry as many manufacturers were suddenly left high and dry. Manufacturers with extended contract manufacturing supply chains, for the first time, learned to truly rely on remote technologies and human nature.

Even some of the top manufacturing executives who fought day in and day out to maintain order and control found themselves during Covid lockdowns succumbing to native traits and unable to drive, or focus, on what to prioritize and solve. (Read about SAP ERP challenges)

Formulating strategy

As manufacturers increasingly search for ways to become more competitive, mandates determined in board rooms to focus on cost and spend become more visible in management meetings. For electronics product and equipment companies the question becomes, "How can we make cost modeling decisions and budget forecasts for our programs based on lowest costs for components and materials on our BOM?"

In the past, these concerns have typically come from commodity sourcing, purchasing and category managers.

Keeping in mind, materials costs can make up sixty to eighty percent, and more, of total electronics equipment product costs. Part of the answer to the question above is a distribution issue. How can any manufacturer know if they are getting the best price? Having familiarity with business nuances in market verticals plus, knowing how contract manufacturers, distributors, semiconductor and connector vendors set pricing can help.

But pricing is, more often than not, based on perceived (vs actual) availability, and semiconductor chip and components distributors make side deals with contract manufacturers.

Yet, even components distributors are not fully open with EMS manufacturing partners when it comes to BOM components pricing, inventory supply, and database availability.

The truth is, original equipment manufacturers (OEM vs EMS) are losing internal knowledge and expertise as thinning in the ranks of higher 'skilled' manufacturing workforces everywhere are depleted as workers become ill, or leave and take valuable and actionable process and legacy systems information with them.

Management of change (MOC) boards

Wide-spread workforce inadequacies in the manufacturing enterprise have, today, reached escape velocity, unfortunately.

But not all hope is lost. Enterprises wanting help to assess internal contract manufacturing management capabilities and aligning department goals with corporate business objectives can find plenty of consulting firms will to help.

One way manufacturers can snap back is, first, by realizing something is not working.

Turning focus inward, savvy manufacturers invest scarce resources and energy to identify challenge areas, alignments and shortcomings in staffing, roles and responsibilities.

Processes and procedures are also closely evaluated.

This is followed with management of change (MOC) boards and specific milestones and objectives assigned to key team members and department heads. Gone are the days manufacturing product issues were primarily rooted in disconnects between marketing/sales and engineering.

Competitive positioning begins starts with staffing focus

Organizations are living and breathing entities comprised of people. Having the right people in place is important. Manufacturers benefit immensely from suitably-staffed new hires to lead, manage, and implement and dial-in best practices (vs practices common in industry), prepare and get proper documentation lined up, etc...

Venture Outsource can assist with your staffing needs. We collaborate with you and create roles and responsibilities based on your specs and our experience in contract manufacturing industry. We leverage our vast network, and even post job openings to drive inbound interest, if needed, while working discreetly.

We interview, qualify (and disqualify) candidates. We send you only qualified candidates vetted by us. All you have to do is determine whether you can work with them.

Processes and procedures

Many Venture Outsource clients also leverage our proprietary frameworks for identifying criteria used to vet and select contract manufacturers. This often includes preparing effective quote packages with cover letters designed with longer term strategic positioning when first engaging contract manufacturers - prior to receiving quote pricing from providers you are considering.

Also provided are meeting agendas we have already prepared based on our vast experience, plus detailed information about EMS factory touring dos and don'ts, questions when meeting with provider management, and various other project deliverables.

Contract manufacturing supplier quote pricing analysis and comparison

Another key activity where manufacturers can beef up capabilities when sourcing contract electronics solutions is identifying ‘internal’ supplier factory costs while optimizing product bill-of-materials (BOM) target ‘should cost’, and optimizing total land cost.

Depending on manufacturing needs, we can help most manufacturers with our costing modelers and tools, complete with detailed training comparing EMS and CM program quotes from multiple suppliers, identification of excessive provider program fees and costs, and more leading to improved production planning and inventory management capabilities, reduced risks tied to outsourcing program cost escalations and overruns - all defensible using our modelers. You can even run real-time ‘what if’ scenarios during provider contract negotiations.

______________________________________________________

About

What matters when formulating contract electronic strategy? How do you identify supplier profit centers and what are you doing to protect against margin erosion for your outsourcing programs? Why do provider capabilities often not match capabilities they claim? How are you benchmarking your supply chain against competitors?

I’ve spent 25+ years in contract electronics industry setting up contract electronic divisions and running operations, protecting EMS program profits, manufacturing capacity M&A and more. I run a technology solutions firm. A lot of times this means asking the right questions.

______________________________________________________